Blog

Analysing Large Trades on BitMEX

27 August 2020

BitMEX is one of the biggest global cryptocurrency exchanges, with over $2bn traded notional daily. BitMEX specialises in futures contracts, allowing traders to build up both long and short exposure to cryptocurrencies — i.e. to profit from decreases as well as increases in price.

How large is “large”?

The minimum order value on BitMEX’s Bitcoin/USD contract is just $1. The maximum value is $10m! If this sounds like a lot, you might be surprised to see just how big some of the trades on the platform are.

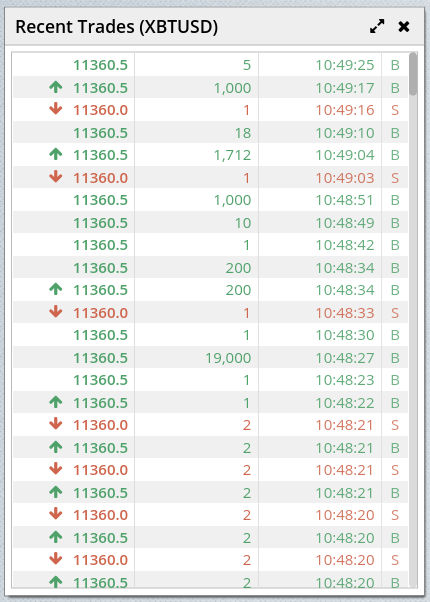

A casual look at BitMEX’s trade feed usually shows something like the screenshot below — frequent trades, most of them below $20k each.

These trades can come from a variety of sources — maybe small arbitrage opportunities, algorithms gradually building up/reducing positions over time, or small traders trading based on signals.

But behind this noise there is a whole world of large trades. These likely come from a different sort of trader — maybe a crypto whale moving in or out of the market, a large trading firm taking on or hedging a significant position.

By filtering the BitMEX trade feed to only look at large trades, we can build up a picture of what these participants might be doing.

What can large trades tell us?

The above screenshot shows the Large Trades feed on CoinLobster, driven by real-time data from the BitMex API filtered to show only trades greater than $500k. All of the above examples are seller-initiated trades (i.e. occurred at the bid).

One thing that’s immediately obvious is that some trades are nice round numbers (like the $1m/$2m trades), whereas others aren’t ($631,847). This suggests that they probably come from different sources, or took place in a different way. The trades with arbitrary-seeming dollar size might be a case of someone taking out an entire level on the book, closing out a position they had which just happened to be that exact size, or hedging a position of a specific size. In some cases these trades will correspond to round amounts of Bitcoin.

The round-sized trades could be someone entering into a new position (why not go for a nice round number there?) or slicing an even larger order into “smaller” $1m chunks.

It’s also interesting to see just how large some of these trades are. In the chart below showing the last 24 hours of large trades, you can see that there was a $4m buy trade! Many of these trades are not far from the $10m maximum trade size.

While this data isn’t as directly usable in a trading strategy as other sources like the liquidations data, with some analysis and judgement it’s clear that it could also be a valuable indicator in any trading strategy.

The above screenshots showing real-time and 24-hour large trades data are taken from our BitMEX Large Trades page. We are actively developing our product, aiming to improve understanding and transparency in Bitcoin Perpetuals markets, so keep an eye on the website as new features are added.

We hope you found this article useful! Be sure to subscribe to our mailing list for further updates, and let us know if there is any content you’d like to see by email or on Twitter.