Blog

CoinLobster Live: Combined Order Book

19 November 2020

Today we are launching our exciting new Live Combined Order Book tool to help crypto futures traders monitor movements across multiple exchanges in real-time.

Why build another tool?

Bitcoin perpetuals are traded across multiple exchanges, and finding the best opportunities means looking at all of them. The problem is that they all have slightly different interfaces, and prices move so quickly that it’s hard to compare directly by looking at the separate pages.

That’s why we built the CoinLobster Live Combined Order Book tool — to take in data from several exchanges, and display it all together in a format that allows traders to easily see what’s happening at a glance.

The tool processes live quote and trade data for BTC/USD inverse perpetual futures across the 4 main exchanges that list these contracts: Bitmex, Bybit, Deribit, and Kraken Futures.

What can I use it for?

There are many use cases, depending on your style of trading. It’s easy to see potential arb opportunities, get a fair value estimate, judge relative liquidity, pause the book to look at orders in detail, and examine price trends.

Below we highlight a few of the things you can do — but we trust that you’ll discover your own use cases when you try it out.

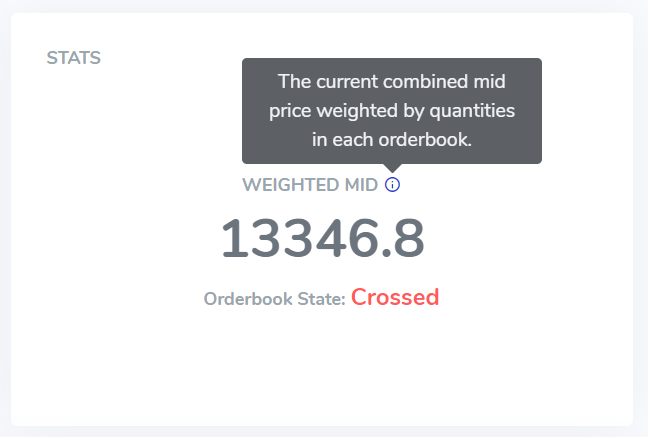

Q: How can I get a ‘fair value’ estimate across all exchanges?

A: The box at the top right corner of the page shows the current weighted mid price across all exchanges. This takes into account not only the prices available at the bid and offer, but also adjusts for the relative volumes available at those price levels. This is just one measure of ‘fair value’ of course — but it avoids some of the potential issues with a straightforward average.

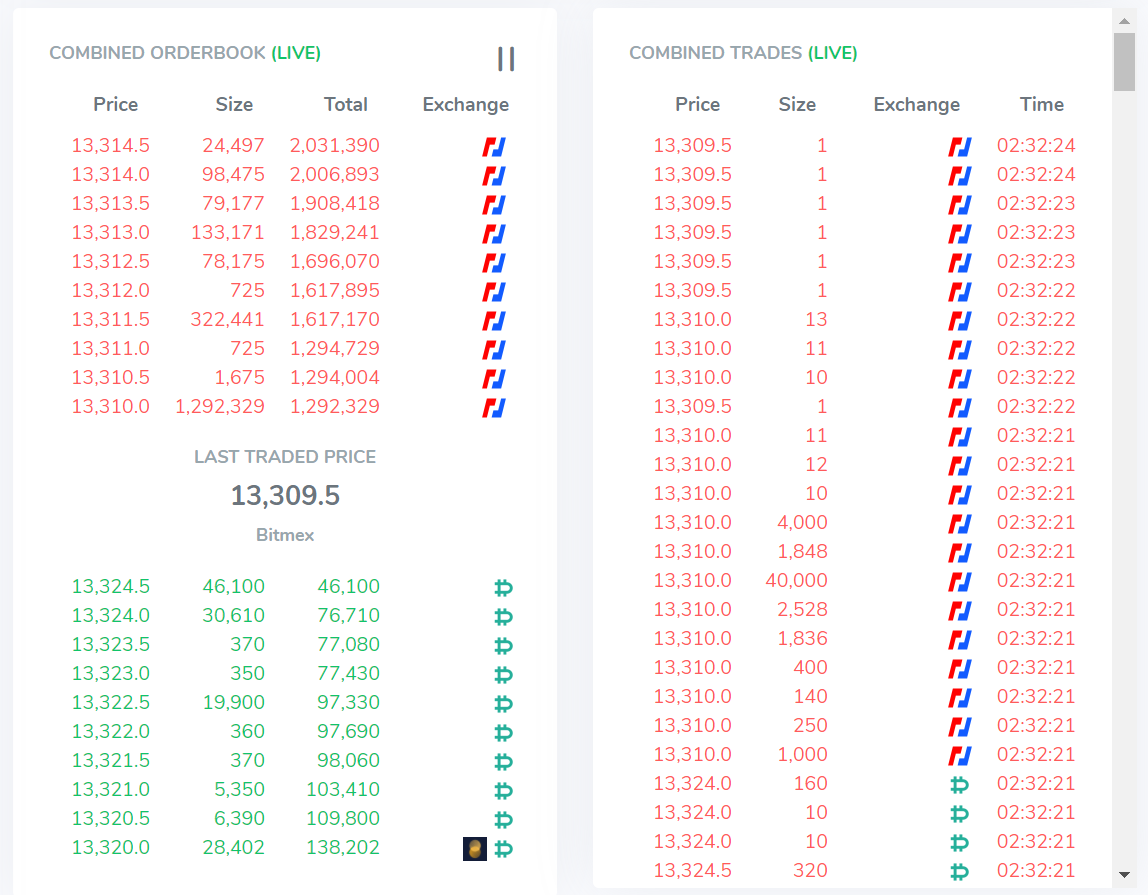

Q: How can I see which exchange has the best price to go long/short right now?

A: The bottom-left box shows aggregate order book data across all exchanges. In the screenshot below you can see that the best bid across all exchanges is at a price of $13,444.5. The logos on the right show that this price is available on both Kraken Futures and Bybit, and the sum of the volumes available there is $878,105. The best offer price is on Deribit, with $20,640 available at $13,344.

Q: Why is FTX/Binance/etc futures data not included?

A: Crypto futures come in many flavours, and few contracts are directly comparable across exchanges. We’ve decided to start by including all exchanges that list ‘inverse perpetual’ futures — those which roll over automatically, and are denominated in USD, in the same way as BitMEX.

In contrast, FTX, Binance, and Huobi list ‘vanilla perpetual’ futures, which roll over automatically but where amounts are denominated in BTC. This makes the price dynamics different, and it would be misleading to just map them directly and show them in the same order book.

But watch this space! This is just the start, and we’d like to provide real-time transparency for more instruments and exchanges. If you’re interested in live data on additional exchanges, sign up to our mailing list to be notified when we add them. Or tweet us to let us know what you want to see!

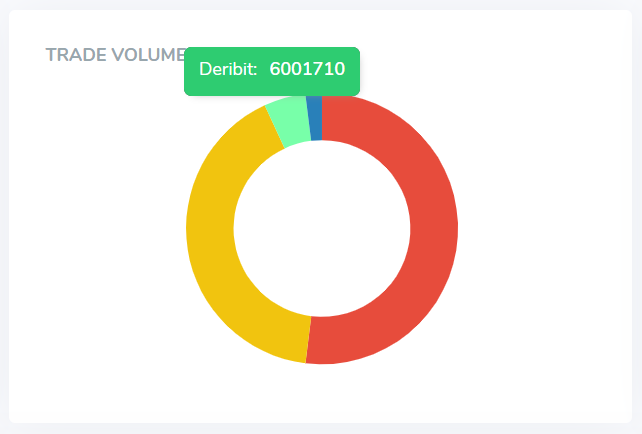

Q: How can I see which exchange has the most liquidity?

A: There are many different ways to measure liquidity! A glance at the aggregate orderbook (see above) will tell you where the available volume is. The top middle widget — “Trade Volume” — shows the relative amount traded at each exchange recently, and hovering over any of the slices shows the absolute volume. For example, the screenshot below shows that more than half of recent volume was traded on Bitmex (red), over a third on Bybit (yellow), and the rest on Deribit (green) and Kraken Futures (blue).

Q: How can I find arbitrage opportunities?

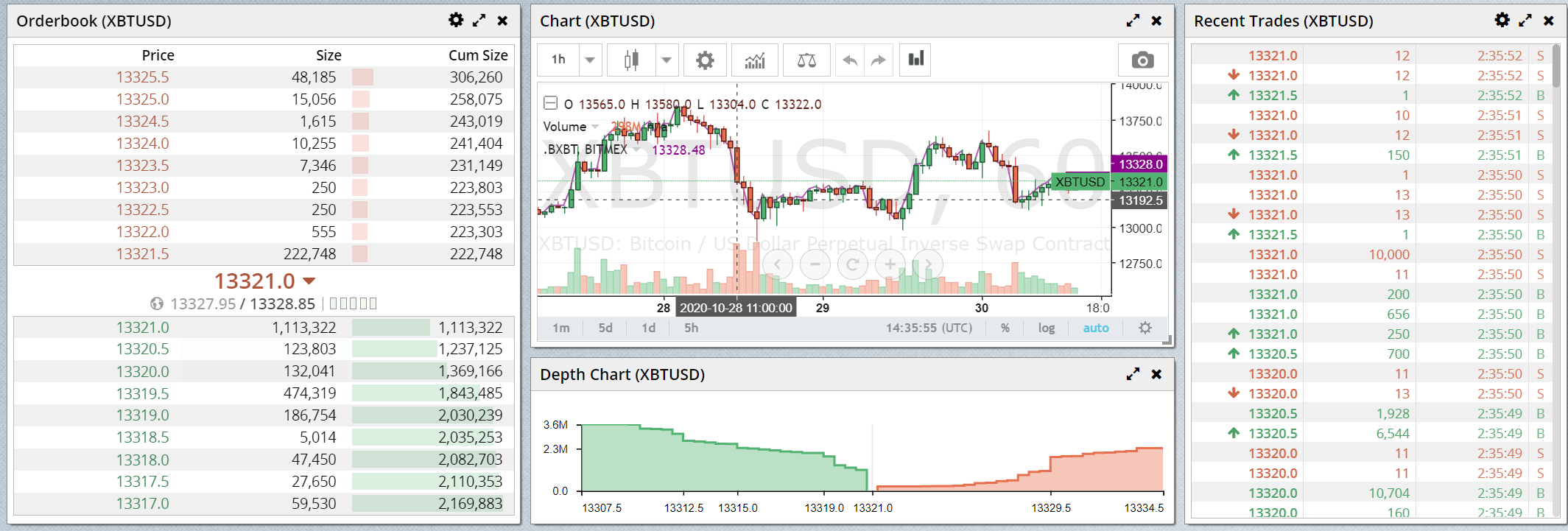

A: Spotting potential arbitrage opportunities is really easy! All it takes is looking at the combined order book and finding a situation where the best bid is below the best offer. For example, in the screenshot below, you can see that there are bids as high as 13,342.5 on Deribit and offers as low as 13,328.0 on Bitmex. Going long on Bitmex and short on Deribit in a situation like this could be the opening of an arb trade — but of course it depends on other things, like the funding rate on each exchange, required to bring prices back in line with the underlying Bitcoin price.

To be continued…

If you haven’t played around with the tool yet, go to CoinLobster Live right now to check it out!

We’ve got many other features planned and we’d love to hear your feedback and suggestions — leave a comment on this post or tweet us at @coinlobster to let us know what you think.

If you want to be the first to hear of new features, sign up to our mailing list! (no spam, we promise!)