Blog

Using BitMEX Liquidations Data to Predict Bitcoin Prices

27 August 2020

BitMEX is one of the biggest global cryptocurrency exchanges, with over $2bn notional traded daily. BitMEX specialises in futures contracts, allowing traders to build up both long and short exposure to cryptocurrencies— i.e. to profit from decreases as well as increases in price.

You may already be familiar with liquidations from the popular Bitmex Rekt Twitter account. In this post we’re going to look at BitMEX liquidations data, how it can be used as a factor in predicting future prices, and the best places to get this data.

What are liquidations, and why do they happen?

To understand liquidations, we first need to look at leverage. The ability to use leverage is one of the features that has driven so many traders to using futures exchanges like BitMEX. This is because using leverage allows you to amplify your gains (or losses!) by up to 100x without needing to increase the amount you put at risk. For more on how this works, see our upcoming post on Bitcoin Perpetuals.

On a normal (“spot”) cryptocurrency exchange, if you invest $100 in Bitcoin and the price of Bitcoin goes up by 10%, you make $10. On a futures exchange like BitMEX, if you use $100 to go long Bitcoin with 10x leverage and the price goes up 10%, you make $100 ($10 x 10)! With 50x leverage, you’d make $500¹.

The nice thing about how these exchanges work is that you generally can’t lose more than the amount of money you put into the account (your “margin”) — the $100 in that example above.

This is where liquidations come in.

Suppose you use $100 to go long Bitcoin with 50x leverage and the price goes down 10%. In theory, this means you would lose more money than you had in the account! Instead of allowing that to happen, the exchange will liquidate your position — effectively creating a trade that balances out the position — and your balance will go down to 0.

How can liquidations data be used to predict prices?

The reason why liquidations are so interesting is that they tend to happen at times of high volatility, and they can set off a chain reaction. Imagine if lots of people are long Bitcoin on BitMEX with high leverage, and suddenly the price drops. This would lead to some big theoretical losses, and might cause one person’s position to be liquidated to stop them losing more than they have. This liquidation effectively triggers a sell order on the order book, causing the price to drop further. This price drop then triggers more liquidations, and so on!

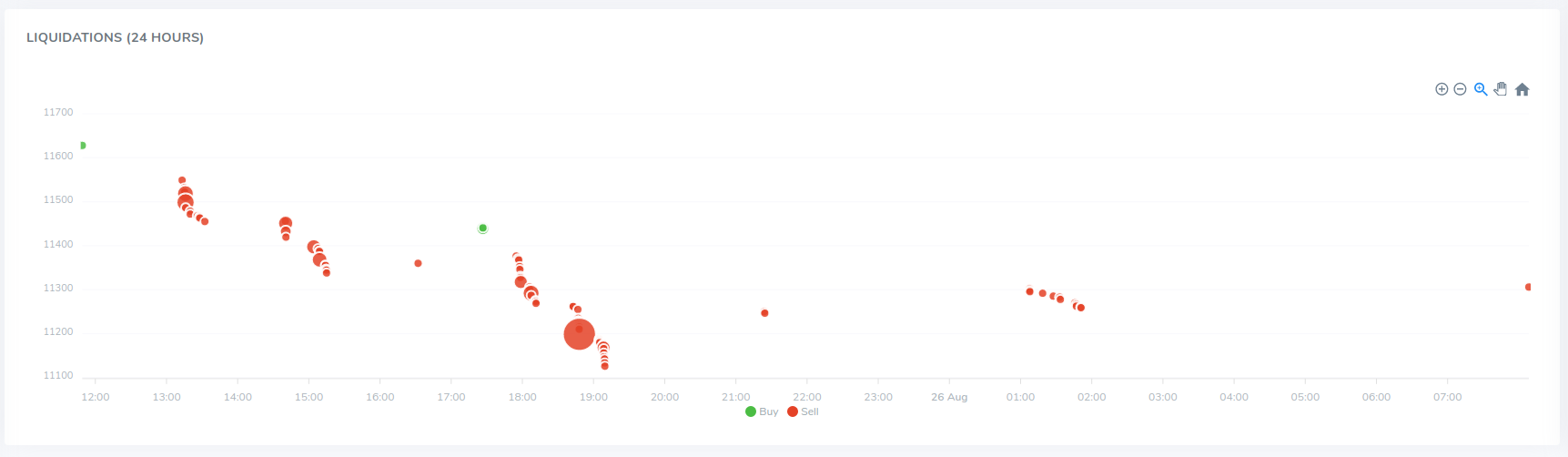

This vicious cycle of liquidations and price moves mean that liquidations can be an extremely valuable signal in momentum trading. Looking at the chart above, you can see the way that liquidations events often happen in bursts. Sell liquidations are in red, and buy liquidations are in green. The x-axis is time, and the y-axis is the price at which the liquidations occurred. There are several separate bursts of sell liquidations followed by more sell liquidations at worse and worse prices.

One simple way to incorporate this data into a trading strategy would be to keep a look out for any liquidations, and open a position in the same direction as the liquidation event, capitalising on the price cascade that follows.

For example: as soon as a sell liquidation happens, open a short position. Wait for the price to go down, and then close out your position at a profit! Of course there is no guarantee that prices will always continue to move after a liquidation (as you can see in the chart above), but when combined with other signals this can be very powerful.

Where can I get liquidations data?

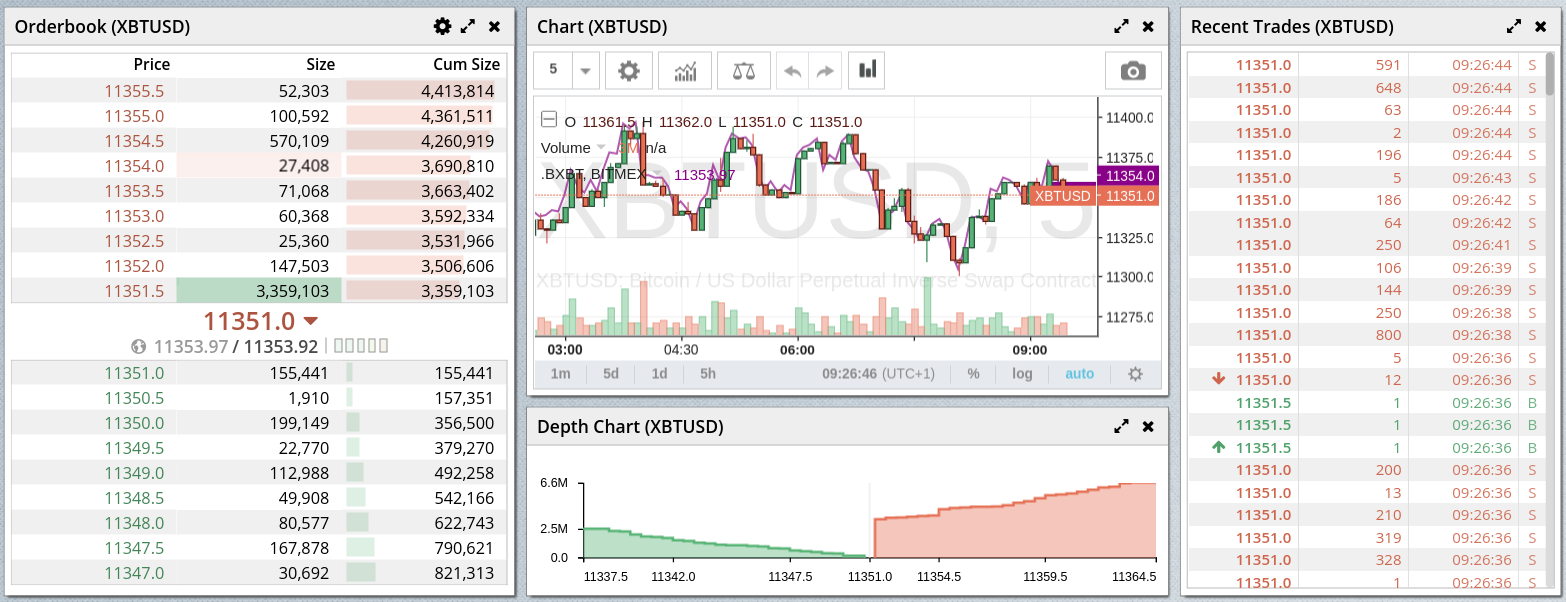

While BitMEX publishes liquidations through their API, it’s not available to traders using the website. Because of this, we at CoinLobster are consuming that data and making it available on our BitMEX Liquidations page. As well as the 24h view shown above and a similar 1h view, there’s a real-time feed on the side showing liquidations as they happen:

This publishes liquidations data directly from BitMEX’s API, and can be a valuable tool for any trader looking for more information on the direction the market is going in!

We hope you found this article useful! Be sure to subscribe to our mailing list for further updates, and let us know if there is any content you’d like to see by email or on Twitter.

[1] It’s actually slightly more complicated than this… see BitMEX’s PNL guide for exact details.